Everything about Wealth Management

Wiki Article

4 Simple Techniques For Wealth Management

Table of ContentsHow Wealth Management can Save You Time, Stress, and Money.Wealth Management Fundamentals ExplainedThe 8-Second Trick For Wealth Management8 Simple Techniques For Wealth ManagementThe 20-Second Trick For Wealth Management

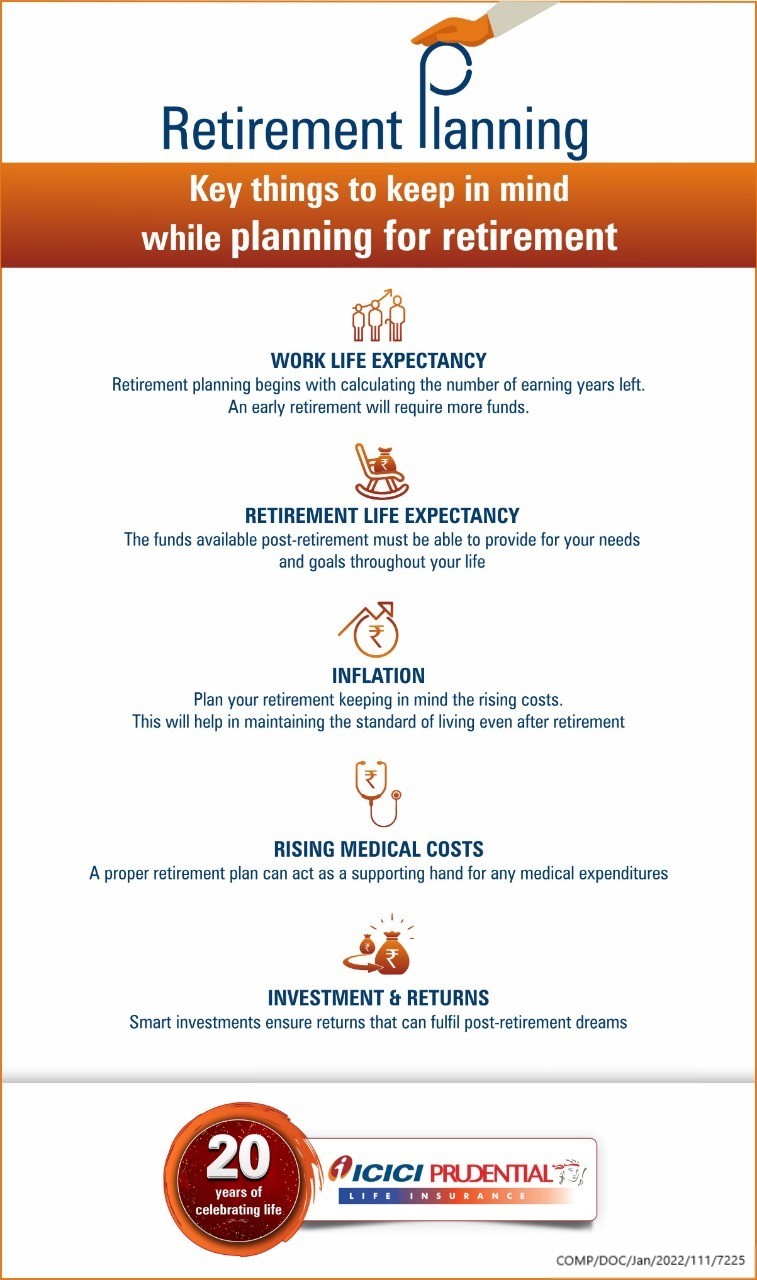

The non-financial aspects consist of way of living options such as exactly how to hang out in retired life, where to live, and also when to quit working completely, to name a few things. A holistic method to retirement planning takes into consideration all these locations. The emphasis that one puts on retirement planning modifications at various phases of life.

Others say most retired people aren't saving anywhere near adequate to fulfill those criteria as well as should adjust their lifestyle to survive what they have. While the amount of money you'll wish to have in your savings is necessary, it's likewise an excellent suggestion to take into consideration all of your expenses.

Unknown Facts About Wealth Management

As well as since you'll have extra downtime on your hands, you might also intend to consider the price of enjoyment and also traveling. While it may be tough to find up with concrete figures, make sure to find up with an affordable price quote so there are no shocks later.

No matter where you are in life, there are several essential actions that relate to almost everyone during their retired life preparation. The adhering to are a few of one of the most usual: Create a plan. This includes choosing when you desire to start conserving, when you desire to retire, and just how much you would love to conserve for your best objective.

Examine your investments every now and then as well as make routine adjustments. It's always a great idea to make any type of modifications whenever there's a modification in your way of living and also when you get in a various stage in your life. Pension come in many sizes and shapes. The rules as well as policies for every might be various.

You can and also must contribute greater than the amount that will certainly make the employer suit. As a matter of fact, some experts suggest next upwards of 10%. For the 2023 tax year, individuals under age 50 can contribute approximately $22,500 of their incomes to a 401( k) or 403( b) (up from $20,500 for 2022), several of which might be additionally matched by a company. wealth management.

A Biased View of Wealth Management

This means that the money you save is deducted from your earnings prior to your tax obligations are taken out. It reduces your taxed income as well as, as a result, your tax responsibility.When it comes time to take distributions from the account, you are subject to your common tax obligation price at that time. Remember, however, that the money grows on a tax-deferred basis. There are no capital gains or reward taxes that are evaluated on the balance of your account until you begin making withdrawals.

Roth IRAs have some constraints. The payment limitation for either individual retirement account (Roth or standard) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some income limits: A single filer can contribute the sum total just if they make $129,000 or much less yearly, since the 2022 tax obligation year, and also $138,000 in 2023.

Facts About Wealth Management Revealed

The STRAIGHTFORWARD INDIVIDUAL RETIREMENT ACCOUNT is a pension offered to employees of local business in lieu of the 401( k), which is pricey to keep. It functions the same way a 401( k) does, enabling employees to conserve cash instantly through pay-roll deductions with the choice of an employer suit. This amount is capped at 3% of an employee's annual wage.Catch-up contributions of $3,500 enable workers 50 or Discover More older to bump that restriction up to $19,000. When you set up a retired life account, the question becomes just how to route the funds.

Below are some guidelines for successful retired life planning at different phases of your life., which is an essential and also important item of retired life cost savings.

Also if you can just deposit $50 a month, it will certainly deserve three times a lot more if you spend it at age 25 than if you wait to begin spending up until age 45, thanks to the delights of intensifying. You may be able to spend more cash in the future, but you'll never ever be able to make up for any lost time.

Some Known Factual Statements About Wealth Management

It's essential to continue saving at this phase of retired life preparation. The combination of gaining even more cash and also the moment you still have to spend and also gain rate of interest makes these years several a fantastic read of the finest for hostile savings. People at this phase of retired life planning ought to continue to capitalize on any 401( k) coordinating programs that their employers supply.Report this wiki page